Download the GoTyme Bank app

Switch to a beautiful banking experience today.

Go for quicker and convenient international transfers with GoTyme Bank. We’ve even made it simple and efficient to send money using your GoTyme Bank account. Just go to the Deposit Page in your app to find your account and GoTyme Bank’s SWIFT code.

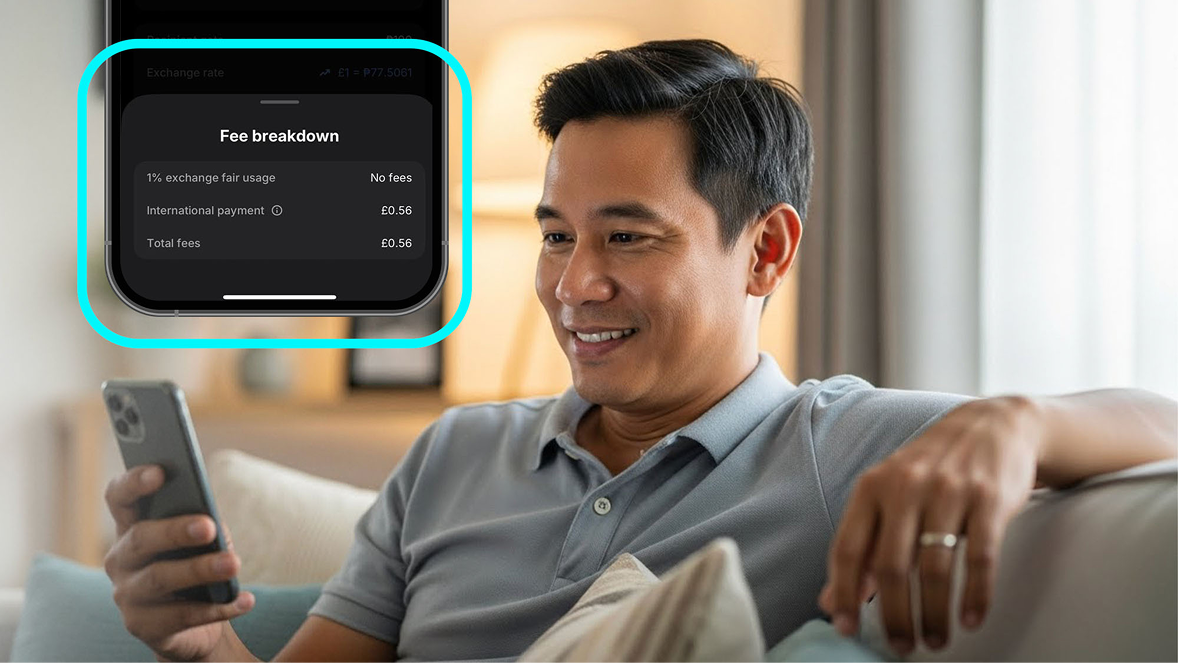

We believe in full transparency. With GoTyme Bank, you always know how much you’ll receive. Our remittance rate is clearly shown before you confirm your transaction. No surprise deductions or hidden charges.

Your money is protected. GoTyme Bank is regulated by the BSP and deposits are insured by PDIC. We use advanced encryption and monitoring tools to ensure every online money transfer is safe, giving you peace of mind every time you send money to the Philippines.

Follow these simple steps to receive your funds directly into your GoTyme Bank account.

Find your GoTyme Bank SWIFT code and account number on the Deposit page.

Share these details with the sender to complete the foreign remittance.

Funds are credited within 1–5 business days, depending on the sending bank.

Ask your sender to use a GoTyme Bank partner remittance service.

Don’t forget to provide your GoTyme Bank account number to the sender.

Then your funds are credited directly to your GoTyme Bank account – no pickup needed.

Provide your GoTyme Bank Visa debit card number to the sender.

Funds are credited instantly to your GoTyme Bank account, with little to no wait time.

Learn more about the different ways to do instant money transfers to the Philippines securely.

| Method | Speed | Cost Transparency |

Partners | Best For |

|---|---|---|---|---|

| Send from your international bank account via SWIFT | Within 5 business days | Upfront, No hidden fees | United States, Canada, UAE, Singapore, Australia, Netherlands, Spain, Italy, Hong Kong, Germany, and more countries ++ | Sending big amounts or salary remittances from abroad |

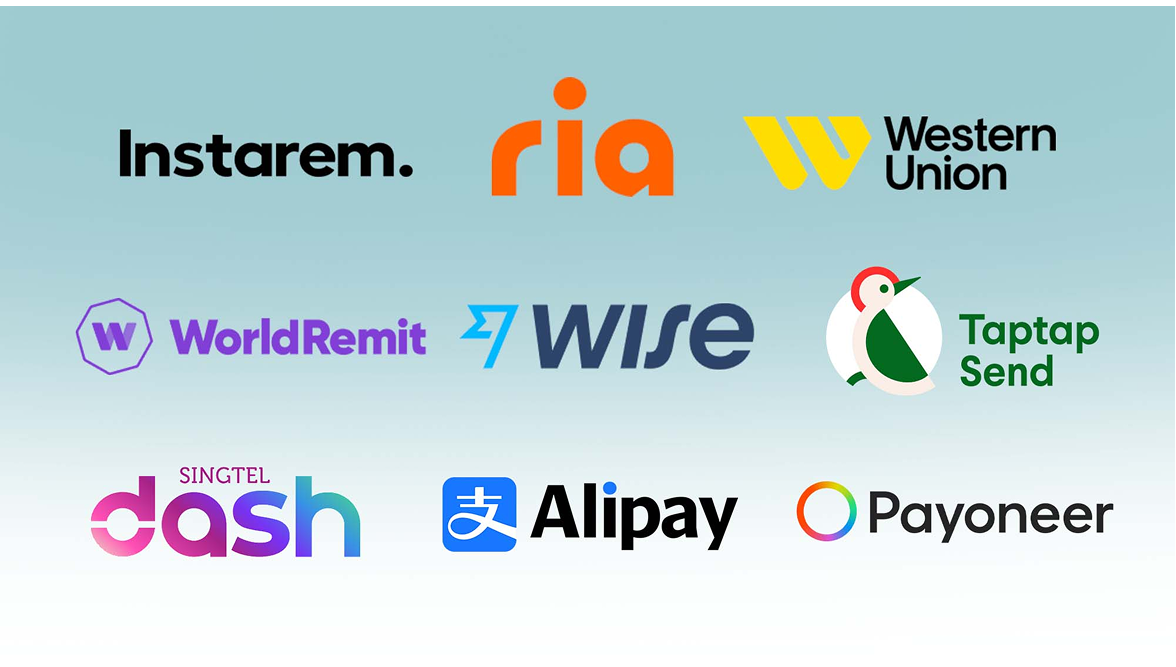

| Send from GoTyme Bank's Partner Network | Same day | Fixed Fees | Western Union, World Remit, Payoneer, Singtel Dash, Ria, Wise and more ++ | For frequent small sends or allowances |

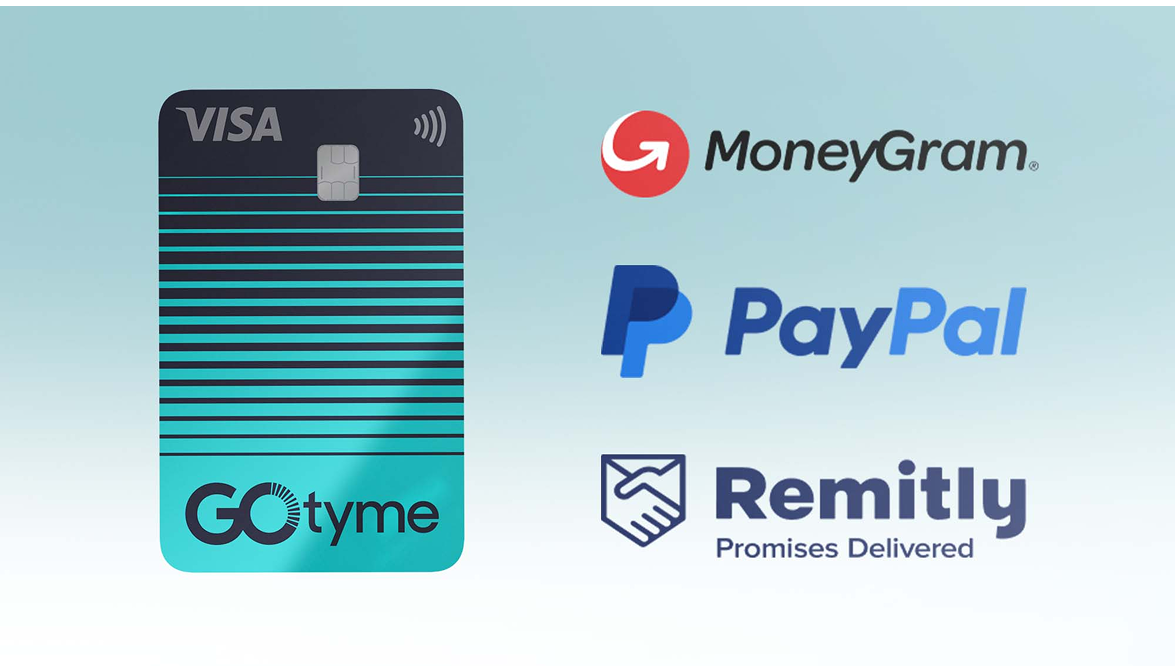

| Send from GoTyme Bank's Visa Partners | Within 30 minutes | Low Fees | PayPal, MoneyGram, Remitly, Revolut and more ++ | For urgent help or quick cash needs |

Remittances FAQs to learn how to track the status of your remittance, check remittance fees in the Philippines, or ensure a secure remittance service.

Yes. GoTyme Bank provides secure remittance services regulated by the BSP, with PDIC-insured deposits and encryption to protect every transaction.

Fees vary depending on the transfer method. Check help section here for more information.

GoTyme Bank can receive remittances from international banks via SWIFT, GoTyme Bank's Remittance Partner Network and various Visa Partners. Click here for the full list.

Currently, GoTyme Bank supports receiving money to the Philippines from the US, UK, Canada, Australia, and more via SWIFT and partner networks.

Just open a verified GoTyme Bank account, share your account number, Visa debit card number, or GoTyme Bank SWIFT code, and you’re ready to receive funds.

Send money to the Philippines hassle-free with secure global transfers from GoTyme Bank.